The regulatory framework for the Distributed Ledger Technology (DLT) in Switzerland was being worked out for years already. The adaption of Swiss law is now getting to the final stages, with overwhelming support from the Federal Coucil, and expected to be completed in 2021. Switzerland has been developing a regulatory framework for DLTs since 2014, following the principle of ‘technological neutrality’. Consequently, Switzerland has been adapting existing principles-based laws to technological innovation in a pragmatic way, aiming to preserve systemic stability, grant consumer protection and favour sustainable investments in the DLT space. The ongoing consultation on the adaptations to various implementing…

Author: Yves Longchamp

One of the advantages of the blockchain technology is supposed to be the added security and resilience to cyber attacks. The open-source nature of blockchains does make them an open target for different types of attacks though. We explore three popular attacks and how to prevent them. Examples of attacks to blockchains range from traditional and general threats that all network platforms face, to unique and specific attacks to blockchains. Before we go into depth about the types of attacks, we identify 4 elements of a blockchain which can face vulnerabilities: Blockchain nodes Smart contracts Consensus mechanisms Wallets Distributed Denial…

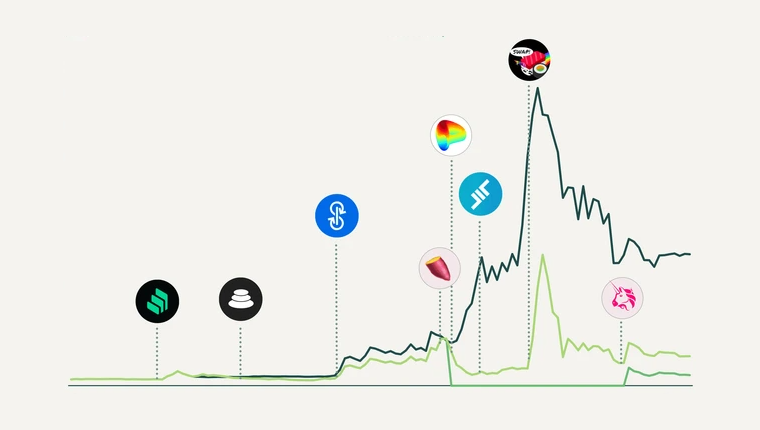

DeFi has been a strong driving force for the digital assets’ narrative this summer. Within DeFi there are multiple investment strategies one could adopt. We analyse the performance of different strategies and conclude that active buying and selling of governance tokens was the best strategy. In the third quarter of 2020, decentralized finance (DeFi) seized a major mind share of the cryptoasset industry. With billions of dollars on public blockchains, the intuitive next step is to generate yield through an on-chain credit system aka the blockchain banking layer. What happened in DeFi this summer is a step ahead in an…

DeFi has significantly improved token design and distribution compared to the ICO era. Still, the current yield farming trend does not seem sustainable. It’s likely that only bigger protocols, which have added value and have defensibility, will survive in the long term. While not yet complete, this year can already be classified as unexpected and surprising! It is unexpected because no one imagined that a novel virus would paralyse the global economy and lead to the greatest economic contraction on record. In the United States, GDP contracted by about one third (at an annualised rate) in Q2—more than in the…

Mining is the process of adding transaction records to Bitcoin’s public ledger of past transactions. This is the only way to create new Bitcoin and is a highly expensive process. We will provide a summary of the history and profitability of Bitcoin mining businesses. Bitcoin mining has come a long way since it launched in 2009. The cumulative revenue from bitcoin mining as of 4 August 2020 was just shy of USD 19 billion, with approximately USD 2.8 billion in revenue to date in 2020 alone. As bitcoin mining becomes increasingly sophisticated, our article investigates the viability of a mining…

As the Ethereum networks get ready to launch Phase 0 of Ethereum 2.0, we discuss the importance of this new technology and its impact on the price of ETH. This transition is one of the most ambitious and challenging tasks in the blockchain industry with the potential to revolutionize decentralised networks. What is Ethereum 2.0? In simple terms, Ethereum 2.0 or Serenity, is a network update that aims to make Ethereum more scalable by introducing new PoS protocols along with upgrades such as, sharding, virtual machine, and more. In this article, we guide you through the updates and changes in…

A growing number of Central banks around the globe are analysing, testing, and prototyping CBDCs. These initiatives are strongly backed by the Bank for International Settlements or the BIS (bank of the central banks). Over the last nine months, Central Banks (CBs) have become more outspoken about their interest regarding CBDCs and their CBDC plans and initiatives. The number of CBs working on CBDC projects has been growing steadily since then. This momentum has been endorsed and backed by the BIS. The official implementation of the first wholesale CBDC is near. The BIS endorsement The BIS annual report 2019, released…

The term ‘token’ is very commonly used in the digital assets space, but few people fully understand it. We explain what tokens are and how they can be used.

Valuation models for digital assets are still rare due to the young age of the new asset class. Which models could provide an approach to valuing cryptocurrencies such as Bitcoin? A closer look at two models and their method. In this article we propose two models to value cryptocurrencies. The first is a comprehensive valuation model that provides a fair-value estimate of bitcoin in US dollars.This model is built around four concepts describing the key characteristics of blockchains (network and immutability) and of cryptocurrencies (monetary policy and currency type). According to our estimate, bitcoin fair value is currently USD 10,670. According to our estimates,…