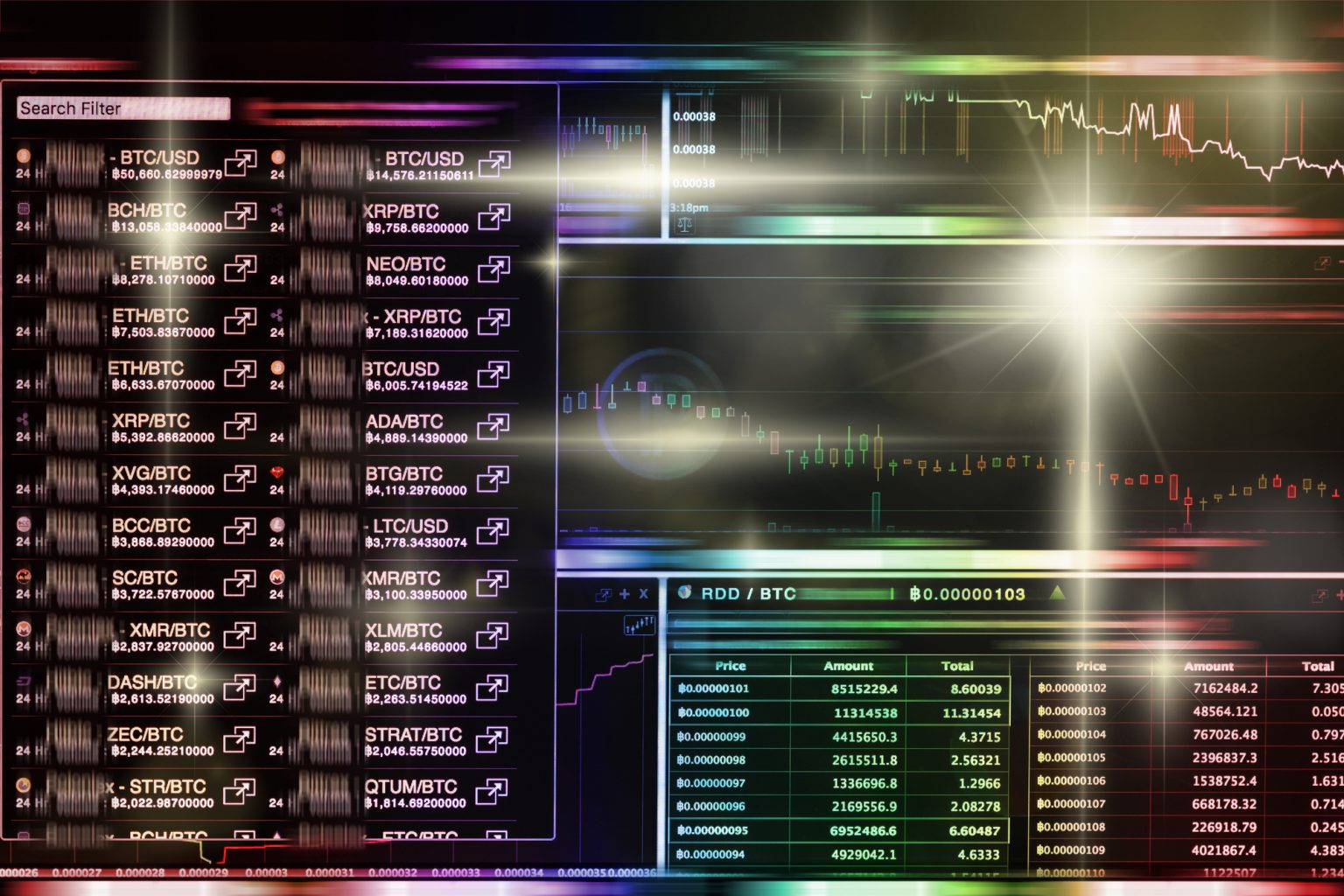

An overview of the trading activities on the cryptomarkets. Studies on traded volumes, supply and demand situations, as well as periodic technical analysis of the most important crypto-currencies and indices, including the perspective of professional Traders. Technical Analysis Good Morning! Bitcoin BTC$ (1h) Even though I was wrong in my “leaning towards the short side” assessment, the guidance along the Ichimoku cloud held very well. The baseline (blue line) never pushed into the cloud. The price never pushed lower than the lower band of the cloud. These would have been triggers to go short. Instead, the rally continued on to…

Author: Patrick Heusser

An overview of the trading activities on the cryptomarkets. Studies on traded volumes, supply and demand situations, as well as periodic technical analysis of the most important crypto-currencies and indices, including the perspective of professional Traders. Technical Analysis Good Morning! This will be our last TA-Tuesday for 2020. In honour of the “king”, it will be just about the BTC$ price action. Since we are in uncharted territory and most people tend to focus on psychological numbers only, e.g. 25k, 30k, and even 50k, I have decided to zoom in to the 1h chart to see what short-term trades are…

An overview of the trading activities on the cryptomarkets. Studies on traded volumes, supply and demand situations, as well as periodic technical analysis of the most important crypto-currencies and indices, including the perspective of Crypto Finance AG Senior Trader Patrick Heusser. Technical Analysis Good Morning! Bitcoin BTC$ (4h) We nearly reached the Bitcoin $25k target we talked about last week. But there is one significant difference to what I was also expecting to see: the so-called “blow-off” top. It did not happen. Yesterday’s sell-off occurred in combination with an overheated/overleveraged market structure and some risk-off waves in the traditional market.…

An overview of the trading activities on the cryptomarkets. Studies on traded volumes, supply and demand situations, as well as periodic technical analysis of the most important crypto-currencies and indices, including the perspective of Crypto Finance AG Senior Trader Patrick Heusser. Technical Analysis Good Morning! What a monthly candle close! Bitcoin BTC$ (4h) The Thanksgiving drop scared quite a few people. In case you were actively engaged during that time, you probably started feeling uneasy around the 16.2k level. But at the same time, large OTC desks started to support the bid and absorbed a great deal of selling pressure.…

Monthly Rotationreport from Patrick Heusser, Crypto Finance AG Content 1 Rotation Analysis 2 Altcoin Futures Basis Analysis 3 Top Ten Comparison 4 Volatility and Correlation Comparison 5 ETHBTC 4h Technical Chart Analysis 6 Market Cap Overview Glossary 1. Rotation Analysis Market correction Altcoins have been trading in a wide range: approx. 15% between 60 and 70. We have therefore revised the support and resistance levels. Ethereum (ETH) was on a roller coaster ride in terms of price movement: USD 320 and USD 480. The MID Index and Shit Index experienced a similar market environment, as the DeFi space began to…

An overview of what is happening in the crypto markets, summarised daily by Crypto Finance AG Senior Trader Patrick Heusser in the market commentary. Market commentary Good Morning! In terms of market moves, it wasn’t really a very eventful weekend. The trading range in Bitcoin (BTC) and Ethereum (ETH) remain the same, and short option holders still have an advantage in such a calm market environment. At the money volatility structure remains rather steep; the same applies to the skew for 25 delta options. The liquidation level of BTC positions has been very low over the weekend (with an average…

Monthly Rotationreport from Patrick Heusser, Crypto Finance AG Content 1 Rotation Analysis 2 Altcoin Futures Basis Analysis 3 Top Ten Comparison 4 Volatility and Correlation Comparison 5 ETHBTC 4h Technical Chart Analysis 6 Market Cap Overview Glossary 1. Rotation Analysis New Rotation Report Frequency We mentioned our report revamp last month. For starters, we will now be issuing our report monthly instead of weekly. We also want to go “back to the roots” of the original idea behind the report. We will start focusing more on crypto/crypto flows again as well as on the sentiment in the market. New to…

Market Commentary von Patrick Heusser, Crypto Finance AG Good Morning! The music is playing the tunes in the altcoin space – or, to be more specific, particularly in the DeFi sector. The top spot is almost showing 1000% return on a YTD basis. Important to note is the fact that the market caps of the top four spots are all over $100 million. Even some real large caps like Cardano ($3.8 billion) are showing a YTD performance of 290%. Still no Alt-Coin season like in 2017 This is not the broad-based altcoin season that some of you experienced in 2017.…

An overview of the trading activities on the cryptomarkets. Studies on traded volumes, supply and demand situations, as well as periodic technical analysis of the most important crypto-currencies and indices, including the perspective of Crypto Finance AG Senior Trader Patrick Heusser. Market Commentary von Patrick Heusser, Crypto Finance AG Good Morning! It has not really been an eventful week in terms of price movements. Our additional charts (or perhaps the better term is indicators) are heatmaps. Heatmaps are graphical visualisations of both past and present order book statuses. The brighter the colour, the larger the orders are in size. I…

Market Commentary von Patrick Heusser, Crypto Finance AG Good Morning! Half a year has gone by. Let’s look ahead to the next six months. Our half-year review will come out next week in combination with our Sector Analysis Report. A week later, we will share our Rotation Report with you. For the remaining six months of 2020, I am focussing on a couple of topics: – Prime Brokerage – ETH 2.0 – DeFi Prime Brokerage I’m not terribly interested in the kind of services that might be developed next. To me, it is more interesting to see how market players…

Market Commentary von Patrick Heusser, Crypto Finance AG Good Morning! I’ll keep it short today. The main focus right now seems to be on the options expiry. I, however, do not believe that it will trigger a trend change (neither up nor down). This morning we did see some shenanigans happening on Deribit in the perpetual futures contract. We quickly dropped down to 9k; all the other exchanges showed very muted reactions. The volume that went through on Deribit was decent and, I believe, is linked to the options expiry. This might remain the behaviour throughout the day until expiry,…

Market Commentary von Patrick Heusser, Crypto Finance AG Good Morning! Good morning! The DeFi space is in the spotlight again. The new buzzword: “yield farming”. Two main service providers together make yield farming possible: The various lending/borrowing platforms: COMP, LEND, MKR, ZRX, REN, SNX, Y (iEarn) Decentralised token swap protocols: the Curve.fi or Uniswap protocol In this report, my focus will be on Compound (COMP), the borrowing/lending protocol side, and on Curve.fi on the decentralised token swap protocol. Let’s begin with the basic concept of how yield farming works. Borrowing/lending platforms are not new to the crypto space, but…

Market Commentary von Patrick Heusser, Crypto Finance AG Good Morning! I’ll keep it short today. In terms of flow, it was a very dull week with nothing very interesting going on: not on the exchange platforms, nor on the OTC side. The weekly price candle speaks for itself. The overall volume on spot exchanges has continuously decreased since the March sell-off. On the derivatives side, things look slightly different. The OI steadily increased, and is almost back to the level we saw prior to the market crash in March. Also, the volume for futures looks different to what we see…

Market Commentary von Patrick Heusser, Crypto Finance AG Good Morning! Let’s dive straight into the charts. BTC$ (4 hours) Just shortly after last week’s report the market collapsed: $1,000 within 15 minutes. Since then, we are hovering around the 9.5k level, with some unusual wicks on both sides. Looking at the Ichomoku cloud, we are still on the bullish side, but we have seen the first sign of this weakening. We are below the baseline (blue line). Additionally, we have penetrated the cloud, which indicates some consolidation action in the neutral zone. To be honest, there is not much more…

Market Commentary von Patrick Heusser, Crypto Finance AG Good Morning! Here is a very crisp and to-the-point thread about inflation/deflation from Preston Pysh: See here. Central banks drive financial asset prices One thing I would like to add to this thread is a comparison to the global financial crisis. Many might say that central banks have been manipulating financial asset prices for over 12 years now. This is true, but this time central banks are not only intervening and pushing financial asset prices higher, but also handing out checks to the “man on the street”. Don’t get me wrong, this…

Market Commentary von Patrick Heusser, Crypto Finance AG Good Morning! FTX did it again! They launched a new product called… Bitcoin Hashrate Futures They launched 3 contracts: BTC-HASH-2020Q3 BTC-HASH-2020Q4 BTC-HASH-2021Q1 In short, you trade the average hashpower that was being used to mine BTC for a full quarter. The concept is similar to the Fed fund futures, where you can hold the contract until the end date (as opposed to three-month money market futures). This means volatility of the hashrate future will decrease over time due to the fact that each day an unknown value is revealed to calculate the…