Goldman Sachs credits the metaverse with great growth and a new ecosystem for diverse industries in a new report.

Author: Editorial Office CVJ.CH

A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

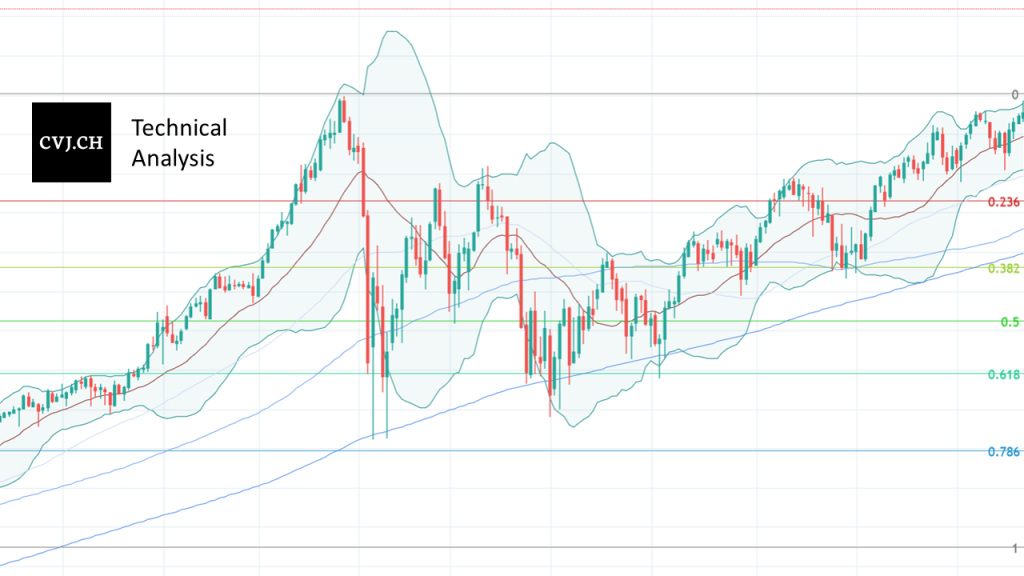

Bitcoin USD daily basis Bitcoin USD Chart Analysis – another test of the 45’000 resistance zone In the reporting week, the price gains of the previous week could be continued. The week began with slight losses, which resulted in a moderate price decline into the area of USD 41’000 on Monday. On Tuesday, on the other hand, there was another upward movement, which manifested itself with a daily high of USD 43’368 and a daily close in the area of USD 42’400. Thus, the market was at the same turning point as 13 days ago, when this zone marked the…

What has been happening around Blockchain Technology and Cryptocurrencies this week? The most relevant local and international developments as well as appealing background reports in a pointed and compact weekly review.

The Swiss exchange SIX is adding two exchange-traded products (ETPs) from Fidelity to its crypto offering.

Ray Dalio’s hedge fund Bridgewater Associates is making a big move into the crypto space as it prepares to invest in a crypto fund for the first time.

The two teams combine efforts to bring wide scale compliance with FATF recommendations, specifically the so-called Travel Rule.

A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

Bitcoin USD daily basis Bitcoin USD chart analysis – 45’000 resistance zone marks preliminary end of the countermovement During the reporting week, a continued bottoming in the USD 38’000 area was confirmed, which subsequently triggered price gains. On Monday, the bitcoin price broke away from the week’s close at around USD 37’800 and gained ground to USD 39’674 by the day’s close. A temporary setback on Tuesday could be changed into only a narrow minus at USD 39’297 by the end of the day. Follow-up buying on Wednesday brought the price up to USD 41’156 at the close of trading…

What has been happening around Blockchain Technology and Cryptocurrencies this week? The most relevant local and international developments as well as appealing background reports in a pointed and compact weekly review.

The acquisition of the CryptoPunks collection by Yuga Labs opens doors for the owners that remained closed by the creators.

A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

What has been happening around Blockchain Technology and Cryptocurrencies this week? The most relevant local and international developments as well as appealing background reports in a pointed and compact weekly review.

State Street will enable its institutional clients to have cryptocurrency custody infrastructure by the end of the year.

U.S. President Biden’s Executive Order calls for acceleration of crypto regulatory and CBDC development efforts.

The Crypto Valley is known to be one of the most “crypto-friendly” regions in the world. A review of the past two months.